In the dynamic realm of tax management services in the United States, precision and efficiency are paramount. Tax Studio AI Solutions emerges as the quintessential partner, offering unparalleled tax filing services. Let’s explore how Tax Studio AI brings transformative solutions tailored to meet the unique needs of tax-focused businesses.

Understanding the Unique Needs of Tax Service Providers

For companies dedicated to offering tax filing services, challenges like client information management, tax form filing, and document handling are critical aspects that define their success. Tax Studio AI addresses these pain points, providing a transformative system designed to alleviate challenges and enhance efficiency.

Client Information at Your Fingertips: A Seamless Experience

Tax Studio AI revolutionizes the handling of client information, providing tax professionals with effortless access to verified client details through a user-friendly interface. This ensures a hassle-free experience, setting the stage for enhanced efficiency and client satisfaction.

Filer Module: Elevating Tax and Financial Form Filing

At the heart of Tax Studio AI lies the Filer Module, an indispensable tool that incorporates Artificial Intelligence to provide unparalleled assistance in real-time tax estimates, write-offs, and the generation of various tax return forms. This strategic asset supports multiple tax jurisdictions with finesse and precision.

Scheduler Module: Mastering Efficiency in Time and Task Management

Efficiency is the cornerstone of success in tax filing. Tax Studio AI’s Scheduler Module allows seamless scheduling of appointments, whether in-office or virtual, integrating with calendars and providing automated reminders. It’s not just a tool; it’s a masterstroke in time and task management for tax service providers.

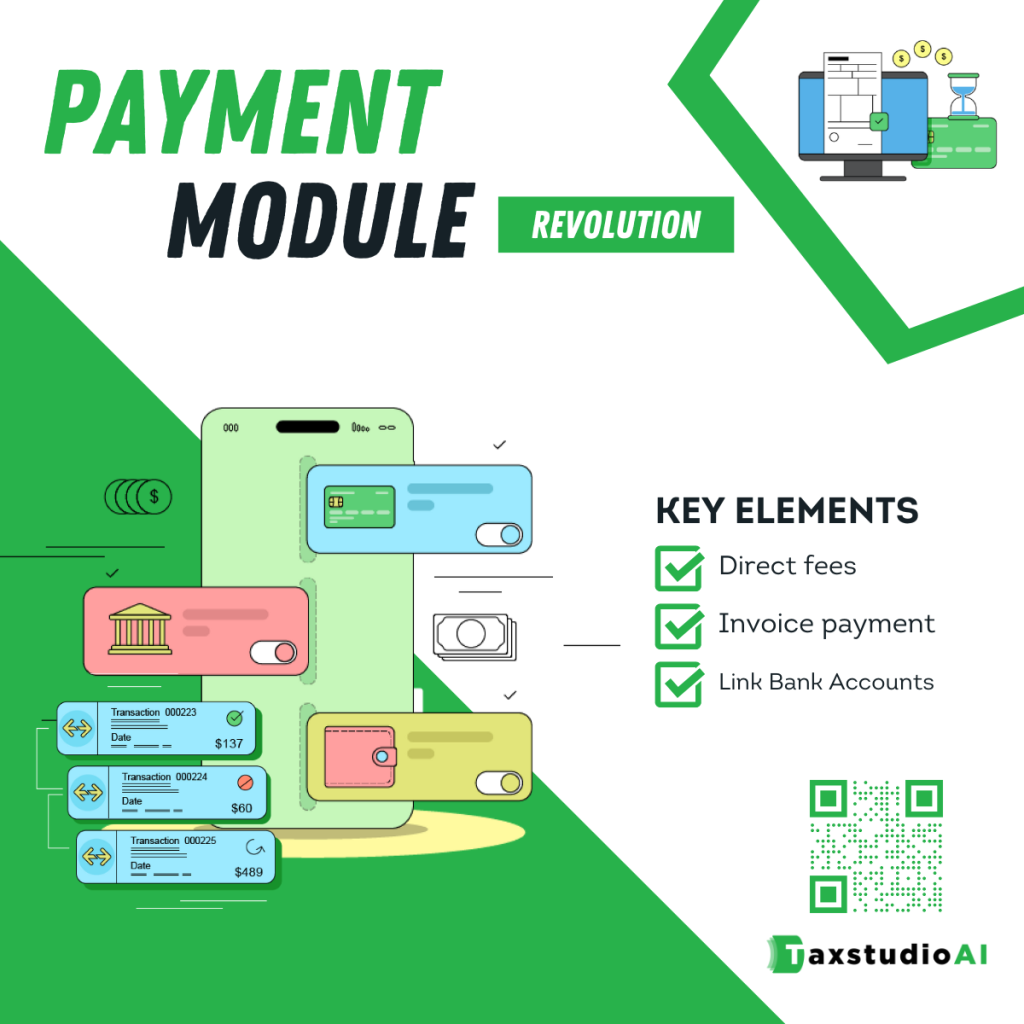

Payments Module: A Transaction Experience Like Never Before

The Payments Module within Tax Studio AI redefines the transaction experience, seamlessly integrating with associated bank accounts for fast and accurate transaction categorization. Multiple payment options cater to diverse user preferences, ensuring worry-free financial transactions.

Document Management Module: Precision in Document Handling

Tax Studio AI sets a new standard for document handling with its advanced Document Management Module. Leveraging AI, this module analyzes and categorizes documents with unparalleled precision. Secure cloud storage and permission-controlled document sharing optimize financial document management for efficiency and confidentiality.

Lending Services Module: Redefining Financial Flexibility

Recognizing evolving financial needs, Tax Studio AI introduces a groundbreaking Lending Services Module. This empowers tax professionals with financial flexibility, allowing direct requests to agencies, cash advances using tax returns, and an AI-powered loan eligibility checker. It serves as a holistic financial companion.

Mitigating Challenges: Tax Studio AI as the Solution

In the fast-paced world of tax filing services, challenges such as data security concerns and cumbersome document handling hinder operational efficiency. Tax Studio AI addresses these challenges comprehensively, offering a solution that streamlines tax filing, document management, and financial transactions for tax service providers.

The Tax Studio AI Difference: Transformative Solutions

Tax Studio AI serves as a panacea for historical challenges faced by tax service providers. It provides a centralized platform for efficient tax filing, document management, and financial transactions, transforming negative user experiences into success stories of streamlined operations and satisfied clients.

Appealing to the Need for Success: A Motivational Message

In the competitive business world, success is not just a goal; it’s a necessity. Tax service providers aiming for unparalleled success need more than conventional tools—they need a transformative solution. Tax Studio AI is the catalyst for success, offering a holistic approach to financial management that transcends traditional boundaries. Embrace Tax Studio AI and elevate your business to new heights of prosperity and efficiency.

Comprehensive Overview of Tax Studio AI Solutions

Tax Studio AI is a cutting-edge solution designed to revolutionize how tax agencies in the United States manage their operations. Below is a detailed exploration of the company and the unparalleled benefits that Tax Studio AI brings to tax management in the B2B sector.

Brief Overview of Tax Studio AI

At Tax Studio AI, understanding the intricate challenges faced by tax agencies is our mission. We empower tax professionals with tools that not only simplify their workflow but also enhance overall efficiency and precision in tax-related processes.

Key Features and Benefits

Our platform goes beyond simplifying tax filing; it’s a comprehensive tool that optimizes operations, secures documents, facilitates transactions, and expands financial services. Artificial intelligence drives every aspect, improving efficiency and providing an exceptional user experience.

Automation with Artificial Intelligence:

- Precise categorization of transactions and documents.

- AI-driven analysis of tax and financial data.

Comprehensive Document Management:

- Analysis and categorization of documents using AI-backed technology.

- Secure cloud storage with encryption.

Efficiency in Payments and Invoicing:

- Retrieval of information from associated bank accounts.

- Creation and sending of invoices with real-time payment status updates.

- Multiple payment options: credit/debit card and bank transfer.

Time and Task Optimization:

- Efficient scheduling of appointments, whether in-person or virtual.

- Calendar integration for easy scheduling and rescheduling.

- Automated reminders via email, SMS, or in-app notifications.

Integrated Financial Services:

- Offering loan services with AI-driven eligibility verification.

- Loan calculator for estimating interest and monthly payments.

Benefits

Increased Operational Efficiency:

- Simplification of tax and financial processes.

- Reduction of errors through task automation.

Security and Document Control:

- Secure cloud storage with encryption.

- Efficient categorization and search for optimized document management.

Facilitation of Financial Transactions:

- Streamlined invoicing and payment tracking.

- Diverse payment options to suit customer preferences.

Time and Task Optimization:

- Improved time management through efficient scheduling.

- Reduction of oversights through automated reminders.

Expansion of Financial Services:

- Offering loans with eligibility verification and integrated calculator.

- Efficient access to additional financial services.

Analysis of Payments Module

Payment Options:

- Multiple payment options: credit/debit card and bank transfer.

- Users can choose the payment method that best suits their preferences.

Security Measures:

- Integration of a secure payment gateway for enhanced transaction protection.

- Assurance of secure transactions to instill user confidence.

User Convenience:

- Simplification of payments for various services, taxes, and fees.

- Real-time update of payment status.

Comprehensive Solution:

- Categorize payment transactions with the help of Artificial Intelligence.

- The platform offers a comprehensive solution for managing payments, loans, and tax.

- Optimizes customer management processes, improving efficiency and security.

Website Analysis of Documents Module

Key Features:

- Analysis and categorization of documents with technology supported by Artificial Intelligence.

- Secure cloud storage with encryption.

- Search and filtering options for efficient document retrieval.

- Permission-controlled document sharing options.

Module Purpose:

- Designed to optimize clients’ financial document management.

- Aims to enhance efficiency and security in document handling.

Functionality Highlights:

- Analysis and categorization of documents with technology supported by Artificial Intelligence.

- Implements encryption for secure cloud storage.

- Offers robust search and filtering capabilities.

- Enables controlled sharing of documents with specified permissions.

User Benefits:

- Improved efficiency in financial document management.

- Enhanced security through encryption.

- Easy and quick document retrieval with advanced search options.

- Controlled sharing ensures privacy and data security.

Emphasis on Security:

- Secure cloud storage with encryption underlines commitment to data protection.

- Permission controls in document sharing add an extra layer of security.

User-Friendly Interface:

- Focus on ease of use for efficient document management.

- Intuitive features like tagging and filtering enhance user experience.

Optimization for Financial Workflows:

- Tailored to the specific needs of financial professionals.

- Aims to streamline financial document processes for increased productivity.

Lending Module Solution Website Analysis

Lending Services Overview:

- Offers loan services: direct request to the agency involved, cash advance using tax return.

- Loan eligibility checker powered by the use of Artificial Intelligence.

- Loan calculator for estimating interest and monthly payments.

- Loan history and tracking.

- Possibility of direct payment through the bank account of the Tax Preparation Fee.

Loan Application Process:

- Requires users to connect their bank accounts.

- Involves the addition of relevant documents for the loan application.

- Allows for the utilization of statements documents for loan processing.

- Offers cash advances using tax return information.

AI-powered Features:

- Incorporates an AI-driven loan eligibility checker.

- Analyzes financial documents, application details, and credit scores to assess eligibility.

- Provides AI-based recommendations or risk assessments based on credit information.

Multiple Loan Options:

- Generates personalized loan offers based on AI analysis, credit score, and loan type.

- Transparently displays interest rates, payment terms, and other conditions.

Repayment and Management:

- Offers a clear repayment schedule with due dates and amounts.

- Users can opt for automatic repayments directly from their bank accounts.

Security, Compliance, and Integration:

- Ensures the encryption and secure storage of all data, especially credit-related information.

- Complies with specific financial regulations for loans and credit inquiries.

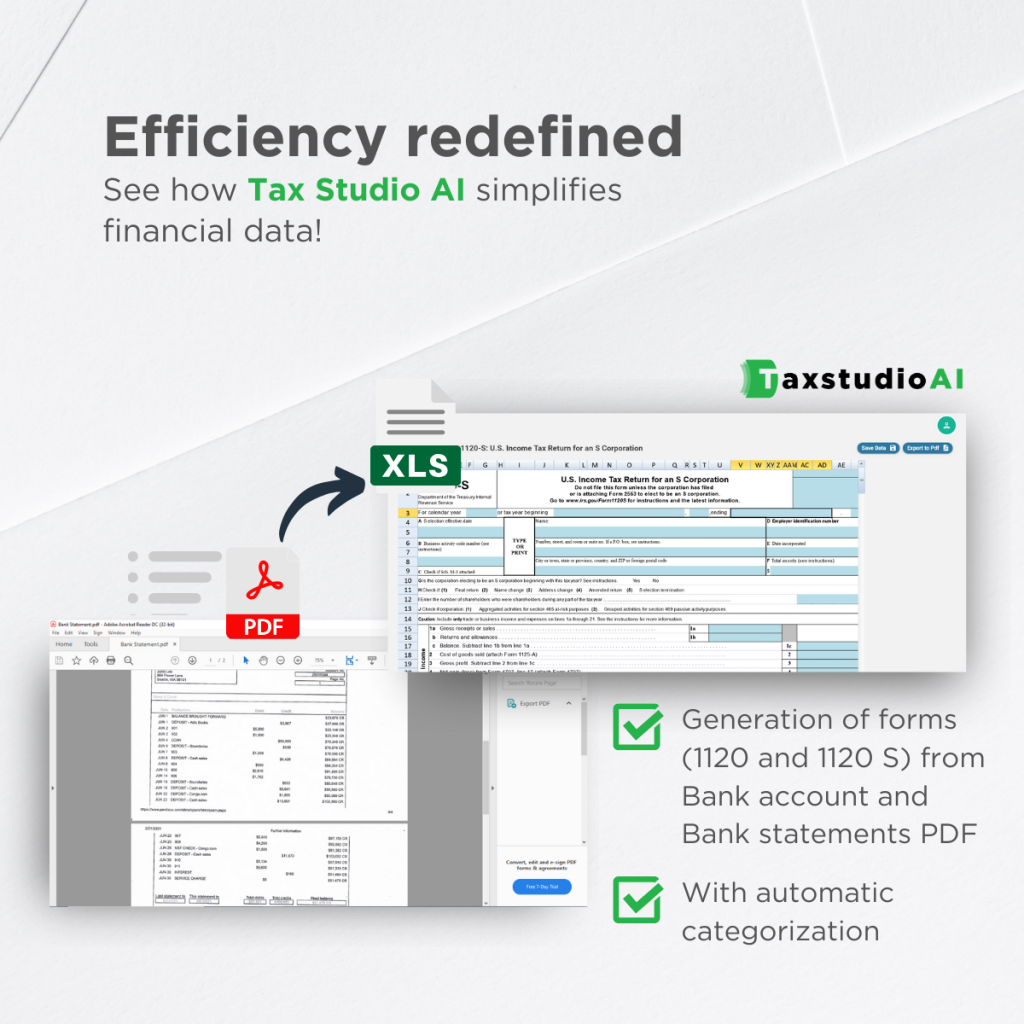

Comprehensive Analysis of Tax Studio AI Filer Module

AI-Driven Filing Assistance:

The Filer module incorporates AI-driven tax filing assistance, leveraging artificial intelligence to extract relevant financial data from documents and streamline the pre-filing process. Users benefit from accurate and efficient tax filing, thanks to the module’s advanced AI-powered capabilities.

Integration with Documents Module:

Seamless integration with the Documents module enhances user experience by providing easy access to necessary files during the tax filing process. This integrated approach ensures a cohesive platform where users can manage both their documents and tax-related activities efficiently.

Real-Time Tax Estimations:

The Filer module offers real-time tax estimations, allowing users to gauge their potential tax liabilities or refunds based on the information provided. This feature empowers users with valuable insights into their financial situation throughout the filing process.

Tax Calculation and Optimization:

Automated tax calculation considers current tax laws and user-provided information to determine tax liabilities or potential refunds. The module goes beyond simple calculation, offering recommendations on tax deductions, credits, and strategies to optimize each customer’s unique tax situation.

Status Tracking and Notifications:

Real-time tracking of tax return submission status is provided, offering transparency to users regarding the progress of their filing (e.g., submitted, accepted, under review). Users receive timely notifications about essential dates, submission confirmations, and any issues that may arise during the tax return process.

Tax Return History and Records:

The Filer module maintains a comprehensive digital archive of all tax returns prepared and submitted through the platform.

Analysis of Scheduler Module

Appointment and Event Scheduling:

Provides a solution for scheduling appointments and events efficiently.

Calendar integration facilitates easy scheduling and rescheduling.

Automated Reminders:

Users receive automated reminders through email, SMS, or in-app notifications.

Aimed at preventing users from missing scheduled appointments or events.

User-Friendly Interface:

Provides an organized and user-friendly interface for scheduling.

Enhances overall user experience in interacting with the Scheduler module.

Conclusion: Transformative Efficiency Unleashed

In conclusion, Tax Studio AI stands as the epitome of transformative efficiency in tax filing. With its AI-powered features seamlessly integrated across modules, it doesn’t just simplify processes; it revolutionizes the entire landscape for tax service providers. Embrace Tax Studio AI, and propel your business to unprecedented success in the ever-evolving world of tax management.

Get started seamlessly with Tax Studio AI. Custom admin panel setup, module configuration, and app publication assistance – every detail crafted for your success. 🚀💻

Remember that you can also read this article on our Medium profile 💬