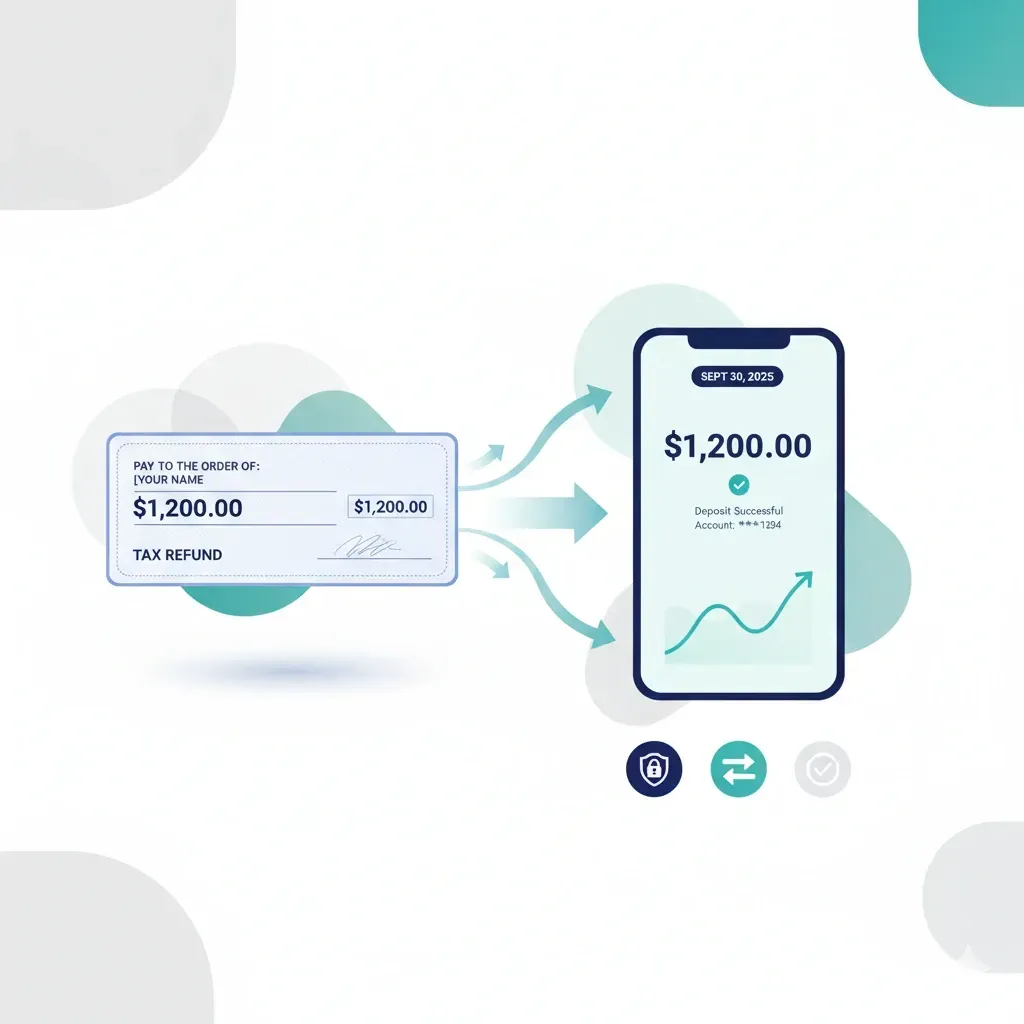

IRS to Phase Out Paper Tax Refund Checks Starting Sept. 30, 2025

The IRS—aligned with Treasury’s push to modernize federal payments—will phase out paper refund checks starting September 30, 2025, beginning with individual taxpayers. Refunds will default to electronic methods (direct deposit or approved prepaid cards). Exceptions apply “to the extent permitted by law,” and official guidance for 2025 returns (filed in 2026) is expected; no change for prior-year refunds processed before that. Firms should collect clients’ bank info now, update intake forms, and prepare scripts for unbanked clients.

What’s Changing—and Why

Policy shift: Treasury and IRS will stop issuing most paper checks and move to electronic disbursements for federal payments, including tax refunds. The IRS confirms the phase-out starts Sept. 30, 2025 for individual refund checks.

Rationale: Reduce check fraud and theft, speed up payments, and lower costs by replacing checks with electronic rails. Treasury’s Fiscal Service has publicly briefed the transition and timing.

Timeline You Can Share with Clients

Now through Sept. 29, 2025: Refunds may still be issued by check under existing rules. (No change for 2024 returns filed/processed before year-end 2025.)

Starting Sept. 30, 2025: Paper refund checks begin phasing out; electronic payment becomes the default for individual refunds, with exceptions as permitted by law.

2026 filing season (for 2025 returns): Expect detailed IRS guidance; taxpayers will likely need to provide direct-deposit info or qualify for an exception.

Who Is Affected

Individual taxpayers receiving refunds. (Business and other segments may follow as policy expands.)

Unbanked/underbanked and vulnerable taxpayers may require special handling or waivers to avoid delays.

Accepted Electronic Options (and What to Collect)

Direct deposit to a checking or savings account (account + routing numbers).

Treasury-approved prepaid debit cards (e.g., Direct Express) where applicable.

Note: IRS policy still references legacy scenarios where a paper check can issue (e.g., routing/account errors that force a reissue). Expect these to narrow as new rules roll in. Plan for edge cases.

Exceptions & Waivers (High-Level)

IRS and Treasury indicate the change applies “to the extent permitted by law.” Expect narrow exceptions for hardship, age, or access constraints, with guidance before 2026 filing season. Build a process to identify and document exception cases.

Impact on Small Tax Firms (2–15 people)

Operational:

Update engagement letters and organizers to require direct-deposit info.

Add e-payment fields to client portals/intake and quality-review checklists (validate names, account types, and ownership).

Refresh refund-status scripts for staff.

Client Experience:

Proactively contact clients historically receiving paper checks.

Provide banking alternatives (e.g., guidance on opening low-fee accounts or using approved prepaid options).

Compliance & Risk:

Train staff on phishing/scam red flags during the transition; expect fraudsters to target refund-method updates.

Reinforce the IRS’s 3-deposit limit per account rule awareness when advising multi-refund households (historic rule still in effect).

Firm Playbook: 7 Concrete Steps This Week

Inventory at-risk clients: Pull a list of clients who received paper refunds last year.

Revise organizers: Make bank info mandatory; include consent language for storing and transmitting deposit details securely.

Portal update: Add required fields + validation for routing/account formats.

QA checkpoint: Add “Deposit Info Verified” to your review checklist before e-file.

Exception flow: Draft a decision tree for hardship/unbanked clients; note potential processing delays if no electronic method is provided.

Comms kit: Send an email + SMS explainer with a secure link to update deposit info.

Scam shield: Train your team; publish a short “we will never ask by text for your PIN” policy reminder.

Client Communication Template (You Can Copy-Paste)

Subject: Action needed: IRS is moving away from paper refund checks (effective Sept. 30, 2025)

Body:

The IRS is phasing out paper refund checks starting September 30, 2025. To avoid delays, please provide your direct-deposit details (bank name, account and routing numbers) in our secure portal this week. If you don’t have a bank account, reply to this email—we can discuss approved prepaid options or whether an exception may apply in your case. Thank you!

(We’ll never ask for credentials or codes by text/DM. Call our office if you get any suspicious messages.)

FAQs Your Clients Will Ask

Will 2024 refunds still come by check?

Yes, prior-year refunds processed before year-end 2025 follow current rules. The phase-out starts September 30, 2025, and detailed guidance for 2025 returns filed in 2026 is forthcoming.

What if a client refuses electronic payment?

They may face delays unless they qualify for an exception permitted by law. Set expectations early.

Is direct deposit safer/faster?

Generally yes; Treasury cites the shift as an anti-fraud, efficiency measure.

Could any checks still appear?

Edge cases (e.g., mis-keyed bank numbers that fail) can trigger a paper reissue under current FAQs. Expect fewer such cases over time.

Watchlist: Pending Details

Formal exception criteria and documentation requirements.

Treatment for business/entity refunds as the transition broadens.

Updated e-file schema and organizer language for 2026 filing season.

The IRS notes it will publish detailed guidance for 2025 returns before filing season.

Bottom Line for Tax Studio Readers

This is a real operational change with real deadlines. Firms that collect and validate direct-deposit info now will minimize refund delays and client anxiety later. Put the process and messaging in place this week—your March self will thank you.