Map the General Ledger to the Tax Return: A Practical Guide for Small Tax Firms

For 2–15 person tax firms (not DIY). If your staff is re‑entering figures from QuickBooks/Xero into tax software, every extra click costs you margin. This guide shows a faster, cleaner way to map the general ledger (GL) to the tax return so your team reviews, not retypes.

Why GL→Tax mapping matters (before → after)

Before: 12 tools, multiple exports, copy/paste, version drift, late e‑signs.

After: One Hub. Zero Re‑Entry. Source‑of‑truth sync, audit trail, and auto‑reminders. You check exceptions; software handles the rest.

Result: fewer errors, faster prep, and a client portal they actually use.

North‑star outcome: replace manual re‑entry with a consistent GL→Tax categories mapping that feeds your return software automatically.

Key concept: From accounts to tax categories

Instead of hand‑keying account balances into return lines, create a layer of tax categories (e.g., Ordinary Income, COGS, Officer Comp, Meals, Depreciation, State Taxes, PPP/Other Nontaxable, etc.). Each GL account maps to exactly one tax category. Your return software (or Tax Studio AI) pulls the category totals into the right places on the tax form.

Guidelines:

One‑to‑one mapping: Each active account → one tax category.

No orphans: Every posting account must map somewhere.

Exceptions bucket: If a balance can’t map cleanly, route it to a review queue (e.g., “Ask‑Accountant” or “Unclassified—Review”).

Auditability: Preserve change history (who/when/what) and keep a link back to the source transaction.

3‑step framework to map GL → tax return

1) Define your tax chart (the category layer)

Start with a lean tax chart that covers 90% of cases for 1065/1120/1120‑S/Schedule C. Keep names plain‑English so juniors can recognize them. Example starter set:

Income: Ordinary, Other, Rental, Interest, Dividends (by type), Nontaxable/PPP.

Direct costs: COGS buckets that mirror the client’s operations (materials, subcontractors, freight, merchant fees).

Comp & benefits: W‑2 wages (by owner/non‑owner if needed), payroll taxes, health insurance, retirement.

Overhead: Rent, utilities, software, insurance, meals (50%/100%), travel, auto.

Adjustments: Depreciation/amortization, Sec. 179, bonus, state taxes, federal taxes (non‑deductible), penalties (non‑deductible).

Other items: Owner draws/distributions, contributions, related‑party.

Keep it short. Add subcategories only when they change the return, the K‑1, or the story you tell the client.

2) Map accounts in bulk

Pull the client’s CoA and batch map accounts to the tax chart.

Use name patterns to speed up: e.g., accounts containing “Meals,” “Dues,” “Subscriptions,” “Insurance,” “Fuel,” etc.

Flag high‑judgment accounts (repairs vs. capex; owner benefits; mixed‑purpose expenses) for senior review.

Lock the mapping once reviewed; version it for audit.

3) Automate roll‑ups and exceptions

Roll‑ups: Sum monthly/period balances by category. Push to the tax return.

Exceptions: Route unmapped or anomalous activity to a review queue. Examples: large manual journal entries, negative expense accounts, new uncategorized accounts.

Diff checks: Compare current‑year categories vs. prior year to spot drifts before they hit the return.

Worked example (illustrative)

Client: S‑Corp, e‑commerce.

Selected mappings:

Sales, Marketplace Fees, Shipping Income → Ordinary Income / Other Income as applicable.

Cost of Goods Sold, Freight‑In, Packaging → COGS buckets.

Owner W‑2 Wages → Officer Compensation; Staff W‑2 Wages → Payroll—Non‑Officer.

Health Insurance—Owner → Officer Benefits (potential add‑back); Staff Health Insurance → Employee Benefits.

Software Subscriptions, Merchant Fees, Dues & Subscriptions → Overhead—Software/Fees.

Meals (Business) → Meals 50%; Employee Events → Meals 100%.

State Income Tax → State Taxes (deductible); Federal Income Tax → Non‑deductible.

Penalties & Interest → Non‑deductible.

Run the roll‑up, push to the return, and review exceptions (e.g., a new “Influencer Marketing” account—decide whether to map under Advertising or COGS based on policy).

QuickBooks & Xero: set yourself up for “zero re‑entry”

Name hygiene: Standardize vendor names and account names. Enforce naming rules at the client portal.

Close periods: Month‑end close before tax roll‑up prevents late edits.

Owner flows: Separate owner health premiums, auto, and perks early to avoid surprises.

Document the policy: A 1‑page mapping policy per client (PDF) saves hours during busy season.

Pro tip: Keep the mapping policy alongside the client’s intake, e‑sign, and document set so your staff can find it in seconds.

Policy decisions you should make (and stick to)

Meals 50% vs. 100% (employee events, office snacks, etc.).

Repairs vs. Capitalization threshold (e.g., de minimis policy).

Owner benefits treatment for S‑Corps/partners.

Related‑party expenses and loans.

Sales tax treatment (exclude from income or map to liability accounts properly).

Write these once, apply across clients, and publish changes as a versioned update.

Common pitfalls (and how to avoid them)

Version drift: GL changed after mapping → lock periods and schedule a sync window.

Orphan accounts: New accounts created mid‑year → exceptions queue + monthly mapping review.

Undocumented overrides: Senior makes a one‑off change with no trail → require comments on every override.

Owner comp/benefits mis‑mapped: Build a dedicated “Owner” review step.

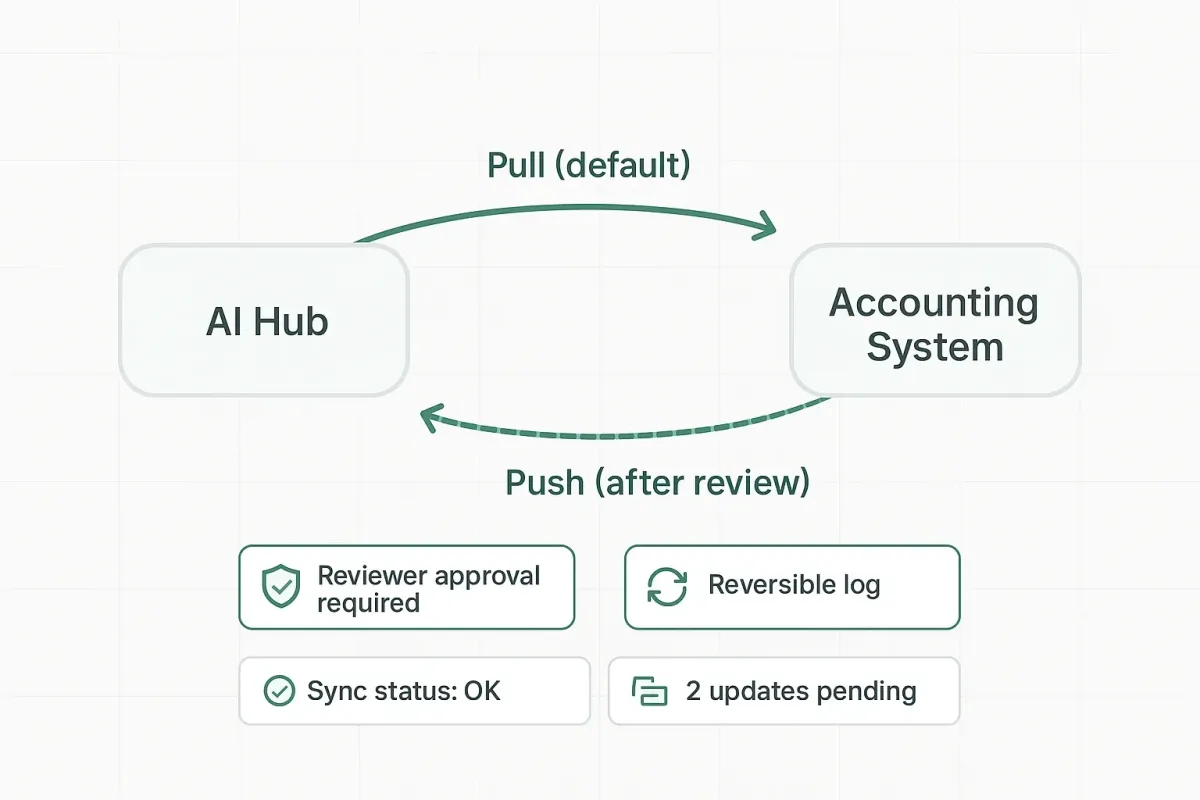

How Tax Studio AI helps (one hub, zero re‑entry)

Single workspace: Intake → docs → e‑sign → mapping → push to return.

Find anything in seconds: Search across docs & accounts.

Auto‑reminders & e‑sign: Less chasing, faster filings.

One‑update sync: Update once; reflect everywhere.

Audit trail: Every change, tracked.

Checklist: 15 minutes to your first mapped return

FAQ

Does this replace my tax software? No. It eliminates re‑entry by feeding clean category totals into it.

How long does setup take? 15–30 minutes for a typical small firm client once your tax chart is defined.

What about different forms (1065 vs. 1120‑S vs. Schedule C)? Use the same core categories; add form‑specific subcategories only when needed.

Can juniors do the mapping? Yes—if you keep category names plain‑English and route high‑judgment items to a senior.

What if the client adds accounts mid‑year? They land in the exceptions queue; review and map monthly.