Automation vs Manual Work in Tax Firms: Real Operational Impact

Discover how automation compares to manual workflows in tax firms, impacting accuracy, efficiency, compliance, costs, and client experience.

US-focused insights on tax, finance, and AI for modern firms and small businesses.

Discover how automation compares to manual workflows in tax firms, impacting accuracy, efficiency, compliance, costs, and client experience.

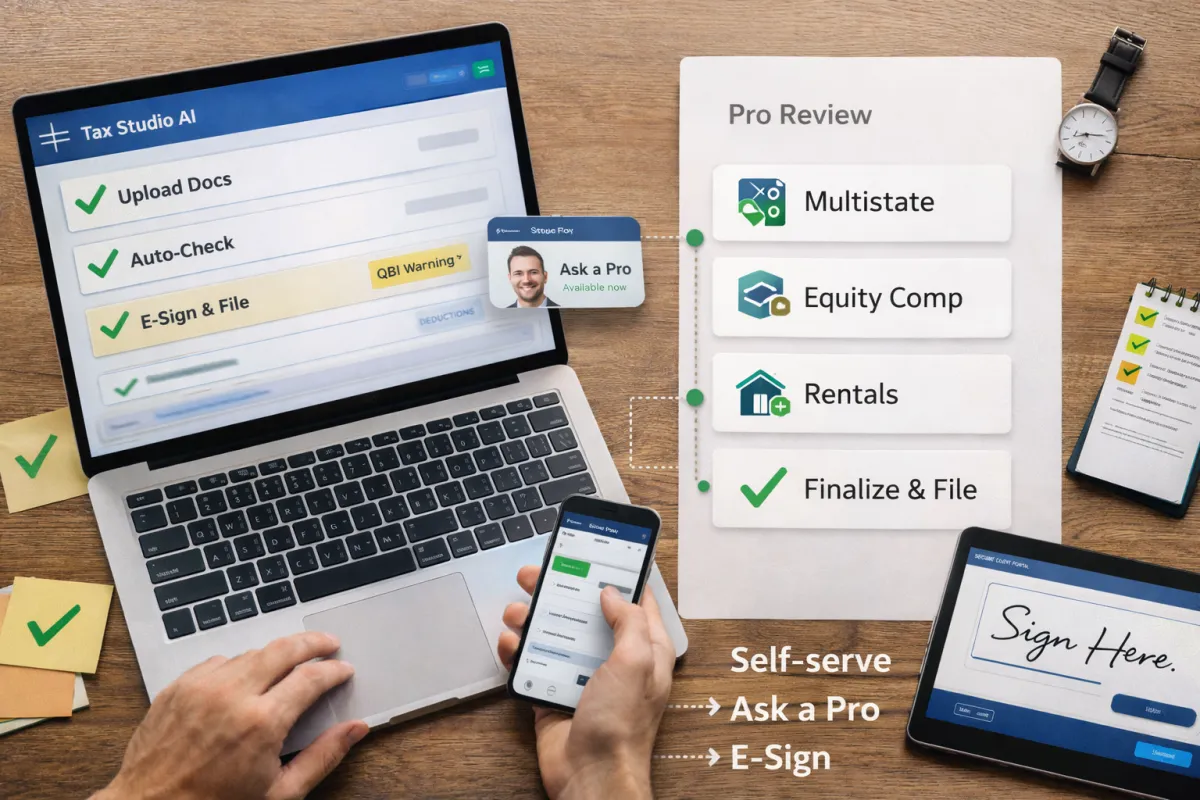

DIY can be cheap. Full-service is safe. In 2026, the smart move is hybrid: self-serve in one hub and call a tax pro on demand. Costs, risks, and a quick decision guide.

Turn client bank statements into reviewed transactions, calculated totals, and pre-filled tax form fields—all inside a focused hub built for preparers.

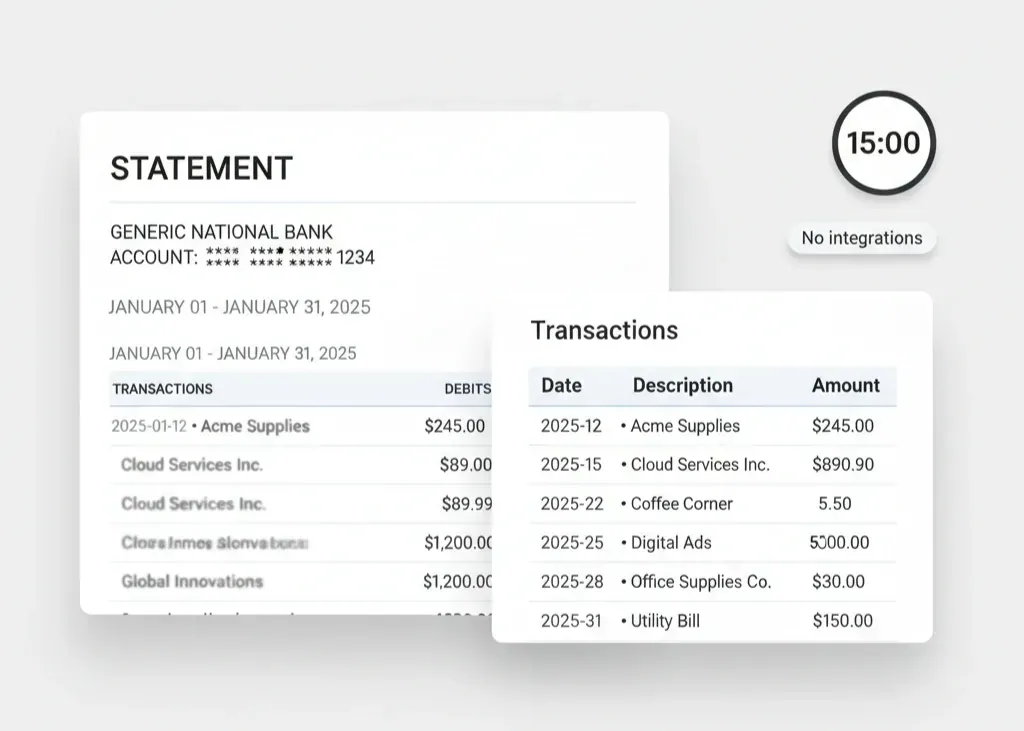

Use AI to turn a single bank-statement PDF into tax-ready insights in 15 minutes—no integrations, no e-sign. Perfect preseason drill for small tax firms.

Switch from reactive to proactive. Learn how AI-enabled, always-on checks help small tax firms catch issues early and review exceptions—not the entire pile.

A practical triage playbook for 2–15-person tax firms: 4×4 priority grid, roles, 60-minute setup, 20-minute daily ritual, templates, and metrics to ship on time.

Join firms saving hundreds of hours with AI-driven document handling, reconciliations, and review-ready outputs—so you can focus on advisory.

7-day free trial. Cancel anytime. Credit card required to start.