Busy Season 2026: A Vendor-Neutral 30-Day Prep Plan

Small firm, big season. If December tends to sneak up while intake forms, missing docs, and signatures turn into a time-sink, this vendor-neutral playbook is for you. Use it to standardize intake, automate reminders/e-sign in your current stack, and connect accounting (QBO/Xero) so your team reviews—not re-types.

TL;DR outcomes

Save 5–10+ hours/week via standardized intake + automated chasers

Reduce “Where is that file?” with searchable naming & tags

Minimize re-entry by mapping GL→tax forms and defining a source of truth

Fewer fires in March thanks to triage rules and completeness checks

What “ready for busy season” looks like

By Day 30, you want:

Standardized intake with missing-item flags and clear next steps.

Reminder ladders (email/SMS) for document upload and signature.

One workflow hub (your existing tools) where docs ↔ e-sign ↔ accounting connect with an audit trail.

Searchable repository with consistent tags and naming.

A triage protocol to handle last-minute returns without panic.

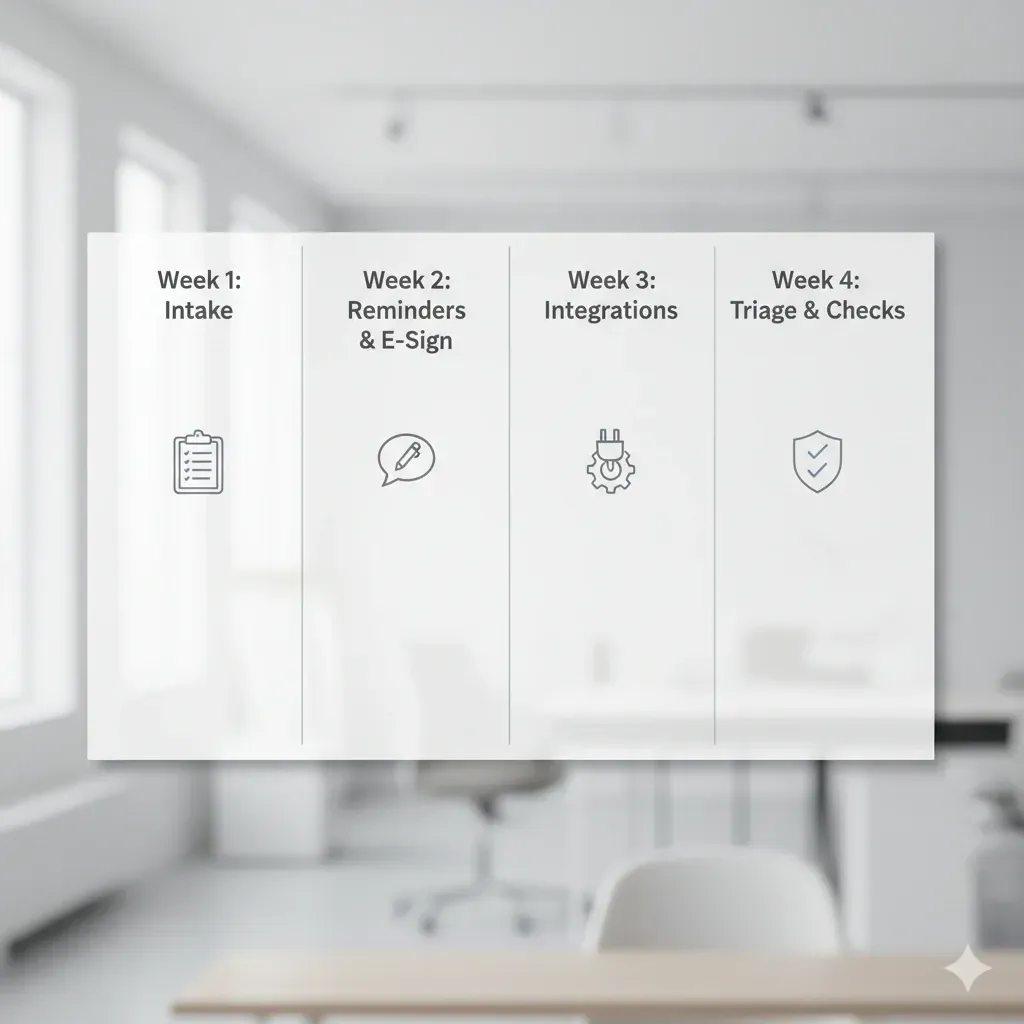

The 30-Day Plan (4 sprints)

Each week has one theme, a short daily checklist, and a Friday “hardening” step to lock changes before moving on.

Week 1 — Intake & Data Foundations

Goal: Replace scattered forms + email back-and-forth with one standardized flow.

Mon–Tue

Choose one intake template per client type (1040, 1120S, etc.).

Add missing-item flags and conditional questions to cut follow-ups.

Wed

Map required documents to each template (W-2/1099/K-1/bank statements).

Enable OCR extraction or structured capture for frequent forms, based on what your current system supports.

Thu

Publish a single intake link per client segment; test mobile UX.

Add searchable tags (entity, year, engagement type) and a naming convention.

Fri (Harden)

Internal dry-run with 3 prior-year clients. Log every extra click—and remove it.

Success check: Clients can finish intake on mobile in one sitting; staff finds any test doc in <10 seconds.

Week 2 — Reminders, E-Sign & Client Experience

Goal: Stop chasing. Let your system nudge, collect, and confirm.

Mon

Build a reminder ladder: gentle at Day 2, firm at Day 5, escalated at Day 8. Personalize with client name + missing-item flags.

Tue

Configure IRS-friendly e-sign in your current software and attach the reminder ladder to signature requests (e.g., Form 8879).

Wed

Add a post-signature handoff: payment link + “what happens next” micro-FAQ.

Thu

Test client portal UX on mobile: 3-step progress bar, plain-language labels, and no dead ends.

Fri (Harden)

Send the full sequence to a dummy client. Verify readability, deliverability, and correct “from” name. Capture audit logs.

Success check: 80% of test clients complete signature without manual intervention.

Week 3 — Integrations & Zero Re-Entry

Goal: Update once. Sync everywhere (within your stack’s capabilities).

Mon

Connect QuickBooks Online / Xero; map core entities (clients, GL, balances).

Tue

Create GL → tax form mappings for your top 3 return types; document edge cases.

Wed

Decide Push vs Pull policy (who’s the source of truth?) to avoid version drift.

Thu

Round-trip test: update a field in accounting and confirm it appears where needed for the return; confirm changes don’t corrupt accounting data. Ensure you keep an audit trail.

Fri (Harden)

Remove duplicate spreadsheets and deprecated folders. Consolidate into your preferred hub with role-based access.

Success check: The team can prep a draft return without copy-paste or CSV exports.

Week 4 — Triage, Continuous Checks & Final Readiness

Goal: Stay calm under deadlines; catch mistakes early.

Mon

Write a triage SOP: severity levels (A/B/C), cutoffs, and reroute rules for last-minute filers.

Tue

Turn on continuous completeness checks (manual or automated) for signatures, outdated IDs, missing docs, and GL variance thresholds.

Wed

Security signals check: visible TLS, 2FA, IP logging, permission reviews—what clients notice first.

Thu

Fire drill: 5 mock returns under a 48-hour deadline. Measure throughput, error rate, and how many manual pings were avoided.

Fri (Harden)

Freeze SOPs until April 15; open a change-log so updates are audited.

Publish a client “How to upload & sign” one-pager to pre-empt “How do I…?” tickets.

Success check: Under simulated crunch, the team follows the triage playbook and the system flags issues before clients do.

Before → After (generic)

Before (Fragmented Stack)

6+ tools (forms, e-sign, storage, reminders, spreadsheets, portals).

Intake via PDF + email; staff re-enters to prep software.

Missing-doc chases eat evenings; signatures trickle in.

Daily “Where is that file?”

After (One Hub, Minimal Re-Entry)

One mobile-friendly intake with clear missing-item flags.

Reminder ladders and IRS-friendly e-sign handle most cases without manual touch.

QBO/Xero mapped to returns; updates sync according to your source-of-truth policy.

Search finds any doc in seconds.

Copy-paste checklist (for your team)

FAQs (generic)

How long does initial setup take?

Most small firms can get core flows (intake, reminders, e-sign) in place within 15–30 minutes, then iterate on mappings and checks.

Which accounting systems should we integrate?

QuickBooks Online and/or Xero cover most small-firm needs. Map GL lines to tax forms and document exceptions.

What about security and auditability?

Keep a visible audit trail of changes, enforce 2FA, and review permissions quarterly. Clients notice these signals.

We’re stuck with legacy tools—does this still help?

Yes. Treat this as a process layer. Start with intake + reminders, then add e-sign and GL mappings. Even partial adoption cuts re-entry and back-and-forth.

Ready to put this plan into practice?

Start your 7-day free trial to see how a modern, one-hub workflow can reduce re-entry, automate chasers, and keep everything searchable with audit trails.