File Solo or Hire a Tax Pro? The Hybrid Option That Wins | Tax Studio AI

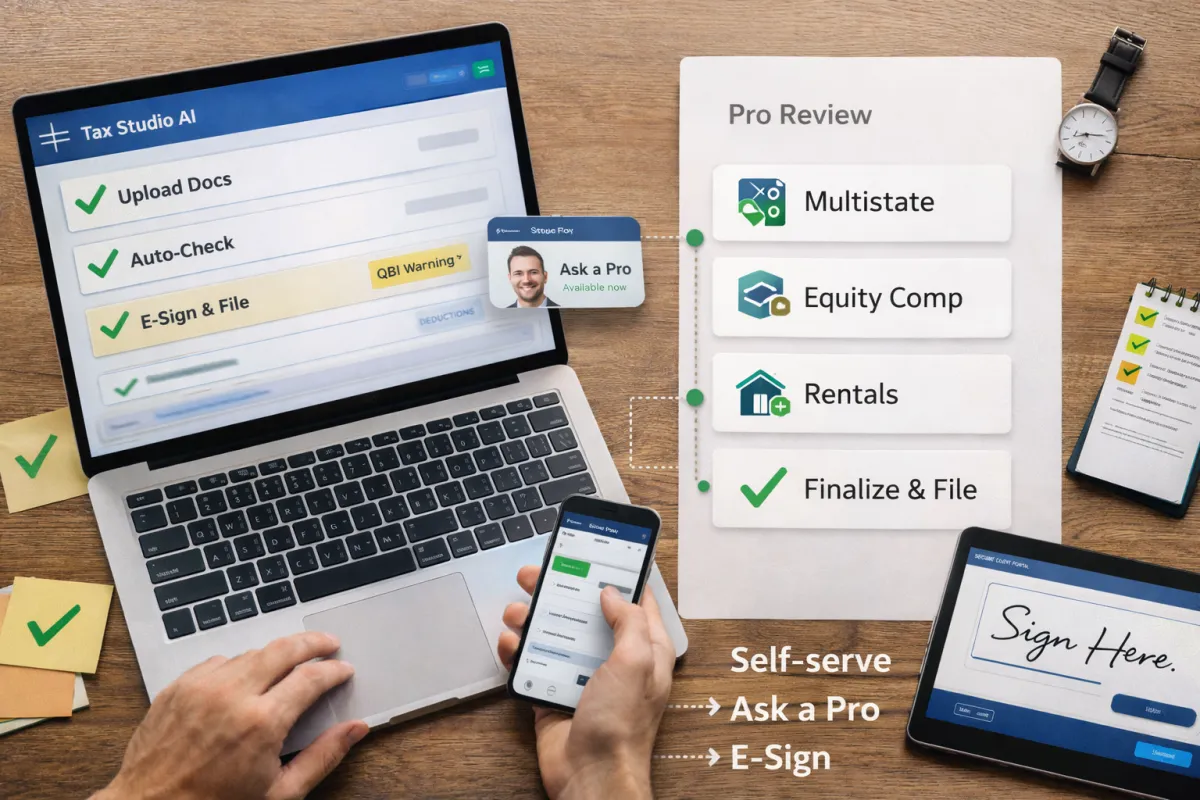

DIY can be cheap. Full-service is safe. In 2026, the smart move is hybrid: self-serve in one hub and call a tax pro on demand. Costs, risks, and a quick decision guide.

US-focused insights on tax, finance, and AI for modern firms and small businesses.

DIY can be cheap. Full-service is safe. In 2026, the smart move is hybrid: self-serve in one hub and call a tax pro on demand. Costs, risks, and a quick decision guide.

Who must file, common mistakes, and why early prep wins. Use our 30-minute checklist to avoid delays and get your fastest, cleanest refund.

A practical 30-day December plan for 2–15 person tax firms to streamline intake, e-sign, triage, quality checks, and capacity before Busy Season 2026.

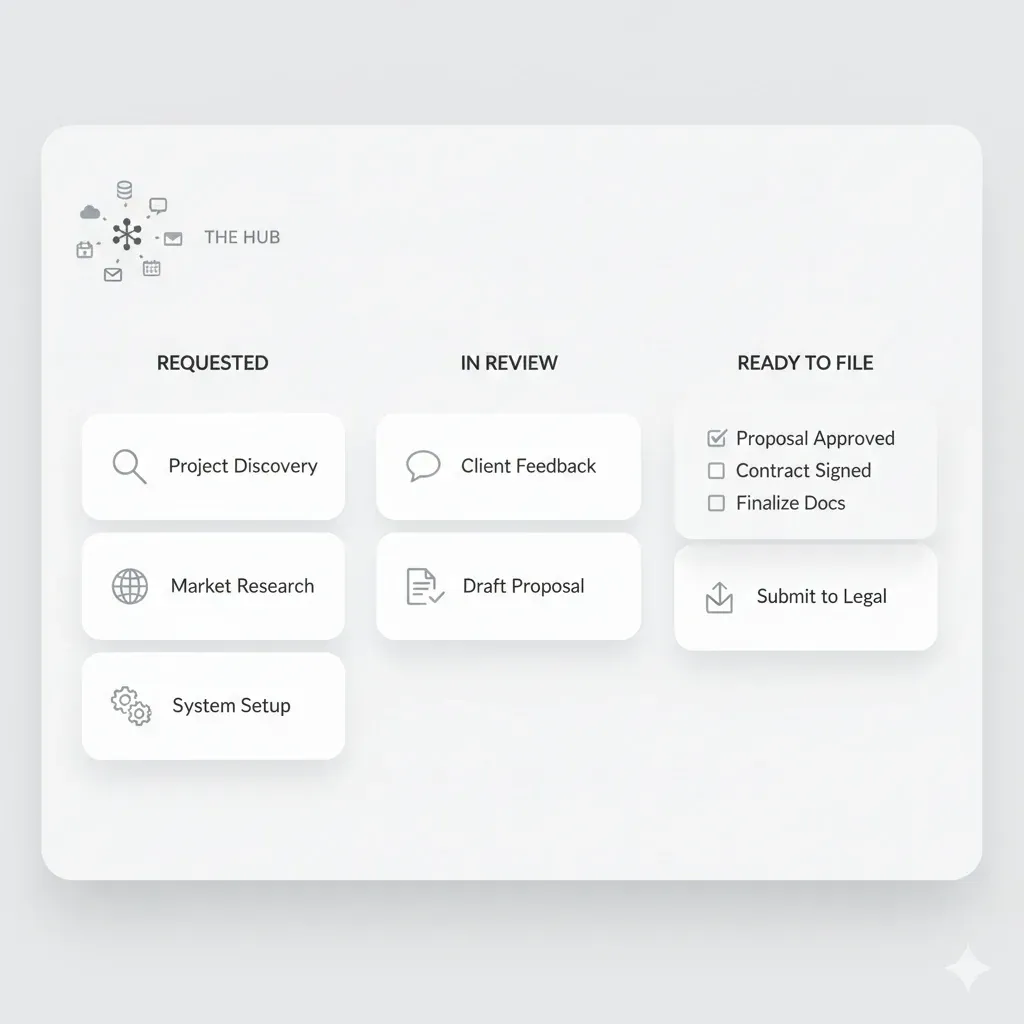

A practical 30-day plan for 2–15 person tax firms to centralize work in Tax Studio AI, cut re-entry, tighten reviews, and get pipeline visibility—no in-app e-sign or reminders required.

Practical playbook for small tax firms to cut tool sprawl and eliminate data re-entry with a central hub, smart integrations, and a 30–45 day roadmap.

A ready-to-paste checklist of RFP/RFI questions to compare modern tax software—integrations, zero re-entry, search, OCR for bank statements, portal, security, and pricing.

Join firms saving hundreds of hours with AI-driven document handling, reconciliations, and review-ready outputs—so you can focus on advisory.

7-day free trial. Cancel anytime. Credit card required to start.