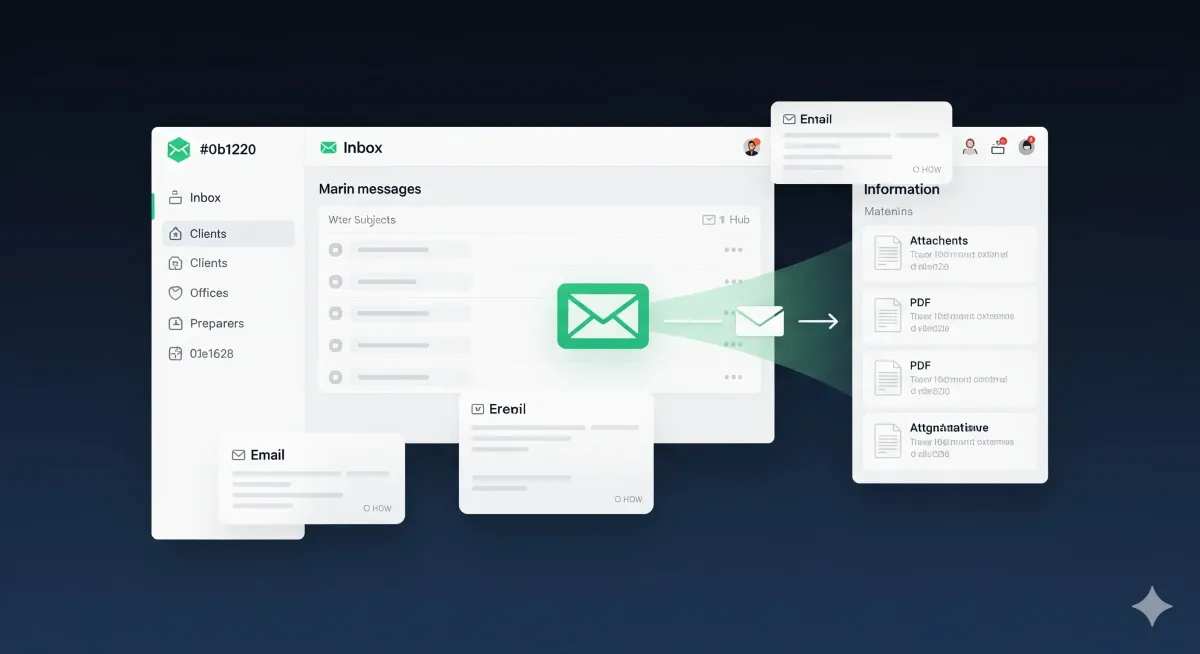

No Client Portal: Clients Email; Your Team Centralizes in One Hub

Your clients don’t have to register anywhere. They keep using email. Your team keeps the firm organized by centralizing client information and documents in Tax Studio AI—sorted by client, office, and preparer.

Why this works

Most clients hate creating accounts, resetting passwords, and figuring out uploads. Every extra step delays your work—and adds a follow-up for your team. During busy season, that multiplies fast.

The alternative: let clients stick to email while your team keeps the system of record in one place. You collect the files from your inbox, upload/attach them in Tax Studio AI, link to the right client, tag the office and responsible preparer, and move on—without losing the thread.

How it works (3 simple steps)

Collect

Clients email documents to their preparer (as usual). You gather the relevant attachments from your inbox.Centralize in Tax Studio AI

Drag-and-drop the files into the hub, link them to the correct client, and add office/preparer tags so workload routing stays clean.Execute the work

Use document data extraction to cut re-entry, reference everything in one place, and keep moving with clear next steps.

Psych levers:

• Ease/Laziness (for clients: zero new steps)

• Before→After (scattered emails → one hub)

• Loss aversion (fewer manual follow-ups and lost files)

Before → After: from email chaos to one organized hub

Before: Email chains everywhere, shared-drive sprawl, re-keying, duplicates, lost context.

After with Tax Studio AI: One hub with filters by client / office / preparer, document data extraction to reduce re-entry, and instant search. Clients keep using email; your team keeps control.

Save 5–10+ hours/week (fewer hoops, fewer hunts).

Zero “Where did that file go?”

Clear audit history across the lifecycle.

UX choices that make it painless for preparers

“Needs attention” view with the very next step.

One-click assignment to the correct client.

Office & preparer tags for clean routing.

Document data extraction to speed accounting/tax work.

Lightning search across clients and files.

Security by default: encryption in transit/at rest; role-based access; audit trail.

Your first 15 minutes to live

Create clients, offices, and preparers.

Upload a couple of sample PDFs from your email to a test client.

Tag & assign (client + office + preparer).

Try extraction on a document and confirm the fields you need.

Work from the dashboard: continue reconciliation, adjustments, prep.

(Note: you’re still receiving documents by email—no client portal required. You simply centralize the working copies and context in Tax Studio AI.)

Mini checklist to stay organized

FAQ

Does the client need an account?

No. Clients can keep emailing their preparer like always.

Can we separate by offices and staff?

Yes—use office and preparer tags/filters to route work cleanly.

What about security?

Encryption in transit/at rest, role-based access, and an audit trail.

How long is setup?

Typically 15–30 minutes—spin up clients/offices, upload a couple of PDFs, tag, and you’re rolling.