One Hub. Zero Re-Entry: How QuickBooks & Xero Integrations Cut Busywork for Small Tax Firms

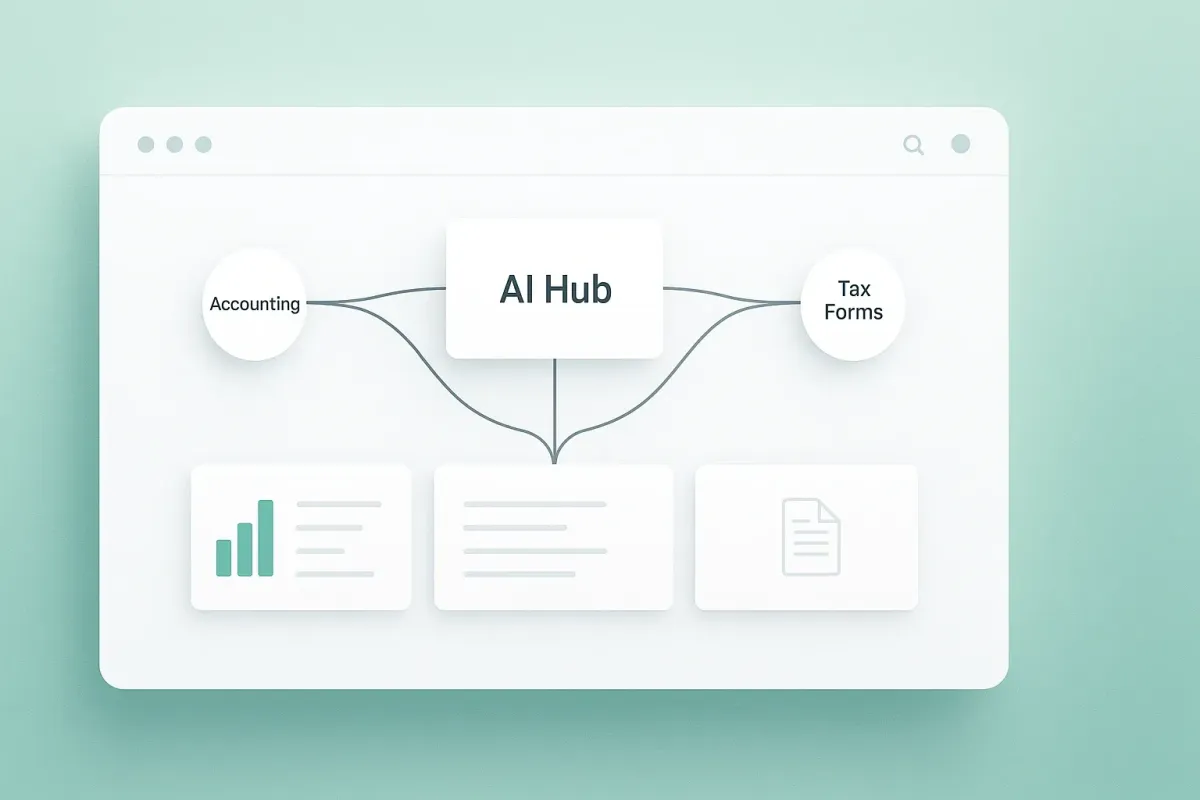

For 2–15-person tax firms, every extra click steals minutes you never get back. Copy-pasting between tools multiplies errors and slows reviews. “Zero re-entry” means one update flows everywhere—client intake, documents, workpapers, trial balance, and tax prep stay in lockstep. In this guide, you’ll see how connecting QuickBooks or Xero to a single AI-assisted hub eliminates duplicate typing, reduces version drift, and helps you ship clean returns faster.

What “Zero Re-Entry” actually means

Update once → sync everywhere. Client profile, entity details, W-2/1099 data, and GL balances stay consistent across your stack.

AI assists, you review. Autofill suggests values; you approve.

Auditability by default. Every change is tracked, so reviews are faster and safer.

Before → After (fast contrast)

Before: 12 tools, manual reminders, portal clients ignore, scattered docs, stale GL.

After: 1 hub, auto-reminders + e-sign, mobile-friendly portal, instant search, live GL sync.

How the QuickBooks/Xero connection works (in plain English)

Authorize once. Secure OAuth to QuickBooks or Xero.

Select entities. Pick the client company files you manage.

Map accounts to forms. Link GL categories to tax form lines (retain mappings for future periods).

Choose sync direction. Pull balances and transactions; optionally push standardized classifications back to accounting to avoid drift.

Review & post. AI flags anomalies (missing docs, odd swings). You approve, then lock.

Mapping GL → Tax forms without pain

Use saved templates. Start from a template for 1040 Schedule C, 1120S, or 1065 and adjust once.

Focus on exceptions. Let AI highlight new or unmapped accounts; map those and keep moving.

Document the why. Add short notes; they appear in the audit log for reviewer sign-off.

Avoiding version drift: “Push vs Pull”

Pull (safe default): Bring current balances into your hub for review.

Push (advanced): After review, push normalized categories or class corrections back to QuickBooks/Xero so next month starts clean.

Guardrails: Require reviewer approval and keep a reversible log.

A 5-person firm example (time math that matters)

Intake autofill + reminders: fewer chases for 8879s and docs.

Zero re-entry on GL: 15–30 minutes saved per engagement when you stop reconciling dueling spreadsheets.

Result: partners review; seniors aren’t stuck re-typing. Small wins add up to 5–10+ hours/week across the team.

15-minute setup checklist

FAQs (quick hits)

How long does setup take? 15–30 minutes for a first client; faster after templates.

Is it secure? Data is encrypted in transit and at rest; every change is auditable.

Can I cancel? Yes—anytime.

Do I need both QuickBooks and Xero? No. Connect whichever your client uses; you can connect both across your book.

What about edge cases? You can pause sync, override mappings, and export workpapers for special situations.