Preseason Tax Drill: AI From One Bank PDF (15 Minutes

Busy season rewards firms that practice before kickoff. This quickstart is a preseason drill for small tax teams: take a single bank-statement PDF, run it through AI, and leave with clean transactions plus a sharp follow-up list for your client. No accounting-system connections, no e-sign, no automated reminders—just a fast, repeatable workflow you can run weekly until January.

Why do this now (preseason)?

Front-load clarity: Clear, standardized transactions today = fewer surprises when filings begin.

Build muscle memory: Practice the same 15-minute drill weekly so the team flies in January.

Push decisions earlier: Turn “mystery transactions” into specific client questions before the rush.

What you’ll need (2 minutes)

A test client (new or existing).

One bank statement (PDF) — required for this walkthrough.

Your Tax Studio AI login (free 7-day trial).

The 15-Minute Drill

Minute 0–2 — Create a scoped workspace

Open Tax Studio AI and add/select your client. Keep scope tight (e.g., “Bank — Jan 2025”).

Minute 2–6 — Upload the bank statement (PDF)

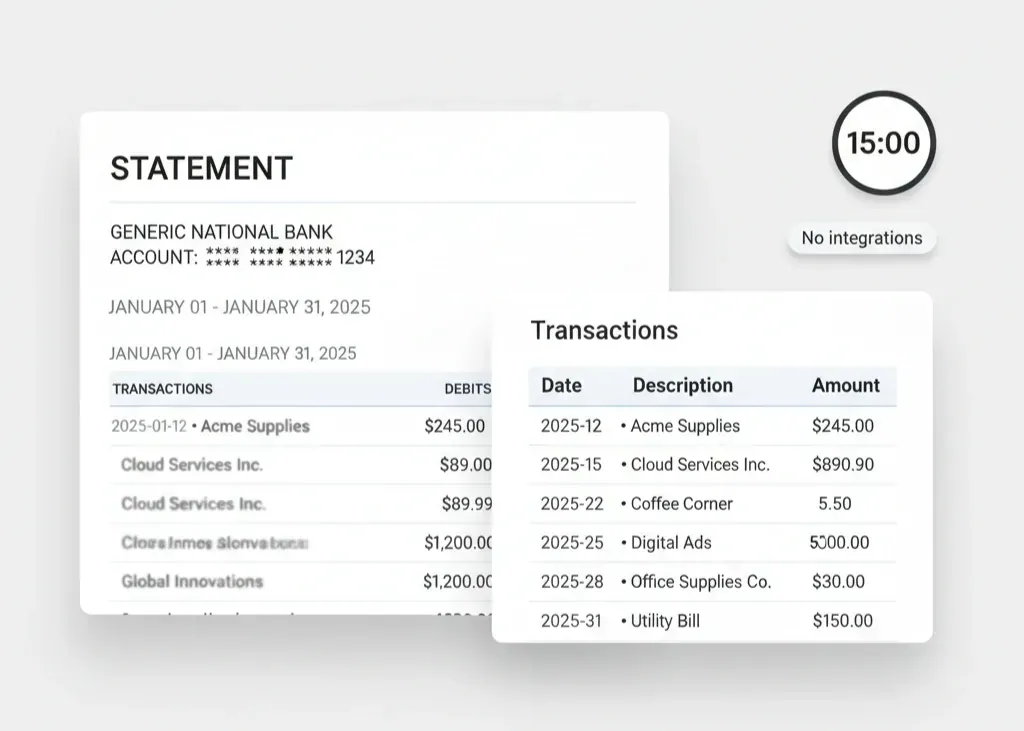

Drag-and-drop. AI extracts transactions (date, description, amount) into a clean table. No manual re-typing.

Minute 6–10 — Validate the extract

Check opening/ending balance and total debits/credits.

Scan for OCR edge cases (8 vs B, 0 vs O).

Normalize any odd vendor names that might confuse prep.

Minute 10–13 — Prepare handoff assets for your workflow

Transactions (clean): copy the table into your workpapers.

Questions list: 5–10 bullets for client confirmation (large cash, transfers, unusual vendors, potential personal spend).

Minute 13–15 — Notify the client (manual message)

Send a short off-platform email/text (pasteable template below). Keep it preseason-framed: you’re getting ahead of January.

Subject: Quick preseason questions to speed your return

Hi {{Client}},

I reviewed {{Month}} banking with our AI tool and need a few confirmations so we’re ready for January:

{{Transaction/Vendor}} on {{Date}} for ${{Amount}} — business or personal?

{{Transfer}} — confirm source/destination?

Any additional docs for {{Category}} (e.g., payroll tax receipts)?

Reply here with clarifications or attach docs.

— {{Preparer}}

Quality checks (use these every run)

What you walk away with before tax season

Time back: no re-typing 100–300 lines from a PDF.

Cleaner inputs: standardized transaction descriptions.

Fewer January surprises: open questions sent early, not during crunch time.

Optional preseason sprints (10–20 min each)

Prior-year dry run: pick one returning client and run two months to stress-test your review routine.

Edge-case hunt: search for cash withdrawals, transfers, and high-variance vendors; capture standard phrasing for questions.

Playbook doc: save your email template + checklist so the whole team can reuse it.

FAQ (current product behavior)

Do I need to connect QuickBooks or Xero?

No. This workflow does not require any accounting-system integrations.

Can Tax Studio AI send automated reminders or e-signs?

Not at this time. Notify clients manually using your email/SMS as shown above.

Will this complete an entire return by itself?

No. The goal is a quick, AI-assisted prep boost that speeds your existing tax process.

How do I take the data out?

Work directly from the cleaned table and copy into your workpapers; keep your normal storage and versioning.